Hi Everyone

Welcome to the 6th edition of the Fear(less) log; glad you decided to still hang around (emphasisis on 'still').

Are you a left-brain-dominant person or a right-brain-dominant person? Never thought about it? Me neither, but actually it can make a big difference in how you deal with fear in trading, in fact how you deal with anything in trading. Let's explore.

As you probably know, trading is a complex activity that requires a variety of skills and abilities. It is neither just executing orders like a machine nor is it 100% relying on your gut…its all and nothing, and it's hard. So let's focus on one aspect of trading that deals with this complex task and doesn't get talked about as much; the role of the brain, more specifically, the concept of left-brain and right-brain dominance.

First, let's briefly review what we mean by left-brain and right-brain dominance. The left hemisphere of the brain is typically associated with logic, analysis, and reason, while the right hemisphere is associated with creativity, intuition, and emotion. Of course, it's important to note that the brain is a complex and interconnected organ (as in listening to the body - discussed many times at Traderistic), and the division between the hemispheres is not always so clear-cut. However, there is some evidence to suggest that certain individuals may have a stronger bias towards one hemisphere or the other, and this can impact their cognitive strengths and weaknesses.

What does this mean for traders?Entering the Grey-Zone

Well, it's easy to see how both left-brain and right-brain skills are valuable in the markets. On the one hand, traders need to be able to analyze data, identify patterns, and make logical decisions based on objective criteria. This is where left-brain dominance can be an asset.

On the other hand, traders also need to be able to think creatively, respond to changing conditions, and manage their emotions effectively. This is where right-brain dominance can come into play.

Of course, the reality is that most traders need a balance of both, left-brain and right-brain skills to be successful.

This is where we enter the GREY-ZONE, and this is also where TRADING-MASTERY begins.

Once traders went through months (or in my case years) of trial and error, thinking we finally have the right strategy and mind-setup in place – just to get punched in the face by Mr. Market over and over again – we start developing a 6th sense, which could be described as a cross-over of left-brain and right-brain.

It is in this phase where you see a setup and your logical left-brain voice tells you “yes, all boxes ticked, except one.” Then your right brain enters the conversation with something along the lines of “ok even though we miss one box, given the current context of the market, we can enter anyway…we could have a tighter SL in case we are completely off”.

See? A purely left-brain trader would just skip the trade (missing one ticked box) and a purely right-brain trader would have no real starting-point at all.

The combination of the two makes a great trader. I personally believe this is something one can not learn from books, videos, or even from fellow traders. It's something very personal that every trader has to develop over time for him/herself.

Who are some of the most famous left/right-brain traders?4 of the best

It's difficult to make definitive statements about individuals' cognitive strengths without extensive testing, but there are certainly some traders who are known for their analytical abilities, and others who are known for their intuition and 'feel' for the markets.

Let's just take four of the most well-known and successful traders:

Paul Tudor Jones and Ray Dalio.

Both of these individuals are known for their rigorous analytical processes and data-driven approaches to trading. Jones, for example, is famous for his use of quantitative models to identify market trends and make trading decisions. This suggests he falls in the left-brain dominant camp, but he is also known for his ability to stay calm and make rational decisions under pressure, which is right-brain work.

Ray Dalio's focus is on economic cycles and fundamental analysis (again, rather left-brain). However, Ray Dalio is also a proponent of mindfulness and meditation and is also very skilled in timing the market and interpreting context (right-brain skills).

George Soros and Jesse Livermore.

These individuals were known for their ability to sense market movements and make quick, decisive trades based on their intuition and experience (right-side of the brain). Soros is a master of using macroeconomic trends (left-brain) but also a master in thinking outside the box (right-side brain). For example, he famously made a billion-dollar bet against the British pound in the early 1990s, based on his belief that the currency was overvalued relative to economic fundamentals.

Jesse Livermore is known for his ability to 'read' the market and make predictions based on intuition (right-brain). However, he was also a master of risk-management and had a deep understanding of market trends (left-brain tasks).

It is important to remember that these traders are complex individuals with a range of cognitive abilities. They are not 100% left- or 100% right-brain dominated.

They managed to enter the Master-Trader zone, where the understanding of the strengths and weaknesses of both left-brain and right-brain thinking gives them a much more well-rounded approach to the markets (the Grey Zone).

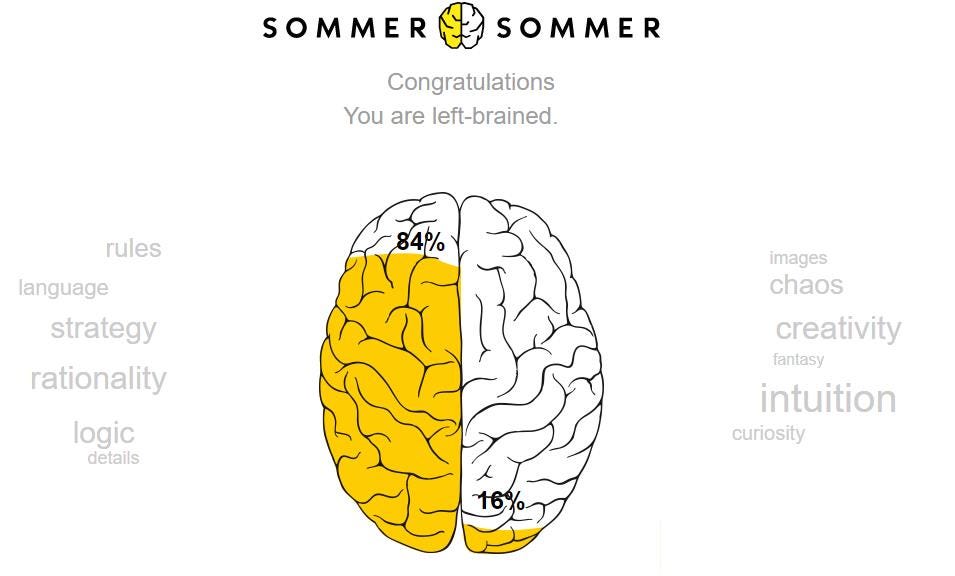

Now, time for some fun: TEST yourself 👇Here is a 30s test to find out your brain-dominance

That's my result above and tbh I did NOT expect that. Some work to do to develop the right-side.

I will share my result on Twitter. If you fancy, tweet yours as well and

tag @traderistic_

Or just respond to this email with your result, I will collect them all and tweet the overall results later.

Final Word

With regards to fear during trading:

It is unlikely that the dominance of one side of the brain over the other would have a direct and significant impact on fear during trading.

That said, If you have a dominant left-brain, you may be more likely to approach trading in a rational, analytical way, and may be better at managing your emotions during high-pressure situations.

On the other hand, if you have a dominant right-brain, you may be more likely to rely on your instincts and gut feelings when making trading decisions, and may be more attuned to the emotional undercurrents of the market.

Overall, it's important to note that the idea of right-brain or left-brain dominance is not a fixed trait, and in reality these regions work together in complex and interconnected ways. The brain is highly adaptable and constantly rewiring itself based on experiences and learning.

Fear during trading and how we react to it is also influenced by a complex interplay of various factors, including cognitive, emotional, and situational factors. Even by our level of glucose as we learned last time :)

However, regardless of your dominant side, learning to manage fear (maybe now is the time to start looking at Traderistic?) and maintaining a calm, rational mindset is essential for success in trading (eventuelly).

Thanks for reading.